A Practical Guide to Islamic Housing and Personal Finance in Singapore

Managing money wisely is essential for every family, and in a multicultural country like Singapore, many Muslim residents prefer financial choices that align with Shariah principles. From buying a home to managing daily finances, Islamic values encourage responsible spending, thoughtful planning, and avoiding financial practices that involve riba (interest), uncertainty, or unethical investments. As the Muslim community grows increasingly financially aware, there is greater interest in topics like Islamic personal finance Singapore and ethical home-buying solutions.

This blog explores how Muslims in Singapore can approach housing decisions using faith-based principles, as well as practical Islamic housing tips Singapore to help families plan smarter, live comfortably, and stay financially secure.

Understanding Islamic Personal Finance in Singapore

Islamic finance is guided by rules that ensure money is earned and managed in a way that is ethical, transparent, and beneficial to society. When we discuss Islamic personal finance Singapore, it usually involves three core principles:

1. Avoiding Interest (Riba)

Loans, credit cards, and financial products that earn or charge interest are not permissible. Instead, Muslims seek alternatives such as:

-

Profit-sharing agreements

-

Trade-based financing

-

Interest-free payment plans

These options ensure that both parties share risks and rewards fairly.

2. Avoiding Uncertainty and Gambling

Islamic finance emphasizes clarity. Contracts should be straightforward, without excessive risk or speculative elements.

3. Investing in Halal Sectors

Islamic personal finance encourages investments in sectors that align with moral and ethical values, avoiding industries like alcohol, gambling, or certain financial markets.

For Muslims in Singapore, this mindset does not limit wealth building—it simply guides it in a direction that is honest, responsible, and spiritually rewarding.

Housing Challenges for Muslims in Singapore

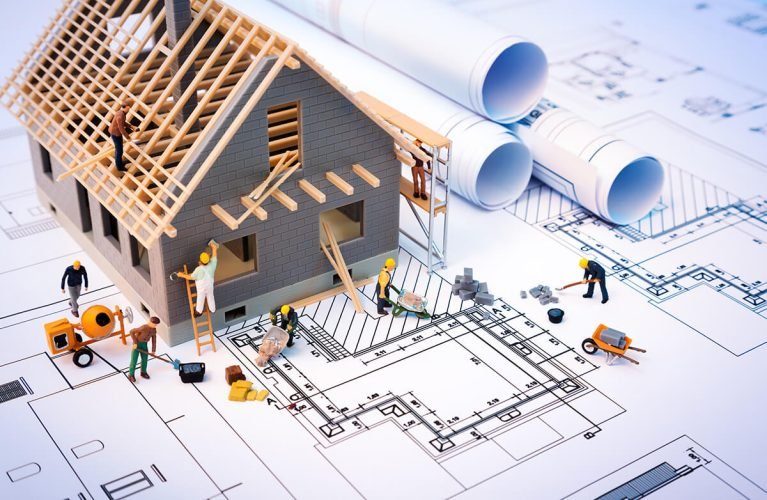

Buying a home is one of the biggest life decisions for any family. Singapore’s property market is expensive, fast-moving, and requires a strong financial plan. For Muslims seeking to integrate faith-based principles into this process, traditional mortgages present a challenge due to interest-bearing financing structures.

This is where Islamic housing tips Singapore play an important role, helping buyers make informed decisions while staying aligned with Islamic values.

Islamic Housing Tips Singapore – How to Buy a Home the Halal Way

1. Consider Islamic-Friendly Financing Arrangements

While conventional mortgages charge interest, Islamic financing options work differently. Some Shariah-compliant models include:

-

Murabaha (Cost-Plus Sale):

The bank buys the property and sells it to the buyer at a profit, paid in installments. -

Ijara (Lease-to-Own):

The bank owns the property and leases it to the buyer until the final payment transfers ownership. -

Musharakah (Partnership Financing):

The buyer and financial institution share ownership during repayment.

Although not as common as traditional housing loans, these structures reflect the principles of Islamic personal finance, ensuring fairness and transparency.

2. Assess Affordability Honestly

Islam teaches moderation and discourages overspending or taking on financial burdens one cannot sustain. Before choosing a home, buyers should:

-

Calculate monthly repayments

-

Consider childcare, transportation, and lifestyle costs

-

Maintain emergency savings

-

Avoid stretching finances too thin

A home should offer security and comfort—not financial stress.

3. Review All Contracts Carefully

A key aspect of Islamic finance is transparency. Buyers should understand:

-

Total purchase cost

-

Penalties

-

Late payment rules

-

Ownership terms

If anything feels unclear or unfair, seek clarification or professional advice.

4. Keep Zakat and Charity in Mind

Islamic financial planning isn’t only about personal gain. It includes giving back. Even while saving for a home, families are encouraged to maintain regular charity, ensuring wealth remains pure, blessed, and shared with the community.

5. Build Long-Term Financial Discipline

A house is just one part of an overall financial journey. Other habits that support Islamic financial well-being include:

-

Saving consistently

-

Avoiding unnecessary debt

-

Investing in halal opportunities

-

Spending within one’s means

These principles apply to both personal budgeting and major investments.

How Islamic Personal Finance Singapore Supports the Modern Muslim Family

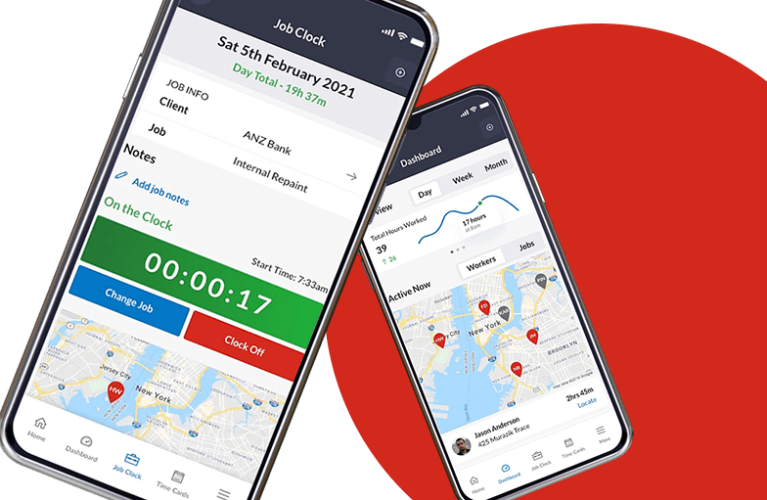

Islamic finance allows Muslim families in Singapore to enjoy modern living without compromising religious beliefs. As more educational programs, workshops, and financial tools emerge, families now have better access to:

-

Halal investment products

-

Islamic insurance (Takaful)

-

Ethical budgeting tools

-

Faith-aligned financial coaching

This shift empowers Muslims to build wealth confidently while staying spiritually grounded.

Balancing Faith, Family, and Financial Goals

Buying a home is a milestone, but it should never come at the cost of financial peace. By blending Islamic principles with smart planning, Muslim families can achieve stable housing, long-term security, and a life guided by moderation and gratitude.

Final Thoughts

Whether you are a young couple planning for your first flat or a family exploring better financial management options, Islamic teachings offer strong guidance. With the right Islamic housing tips Singapore, responsible budgeting, and informed decision-making, achieving homeownership becomes not only possible but spiritually fulfilling.

As more Muslims seek ethical alternatives, the future of Islamic personal finance Singapore looks promising—encouraging a generation that builds wealth with clarity, balance, and barakah.